Don’t blame the smashed avocado or the hipster-brewed coffee – life’s little luxuries and an unwillingness to save aren’t preventing younger people from buying a house.

But here’s a look at the economic conditions that are making it that much harder for first-time buyers to get into the property market.

Wage growth

Wages just aren’t growing at the rate they once did, which affects how much first-time buyers can save.

The Wage Price Index, which was introduced by the Australian Bureau of Statistics in 1997, has never been lower with wages growing at just 2% in the year to June 2016.

If you want to go back further, the average weekly earning stats kept by the ABS show that wage growth hasn’t been this low since the 1940s.

Whereas baby boomers saw their wages grow when they were saving for a home loan, today’s first-time buyers aren’t seeing their wages rise.

Lack of supply

As the REA Group Property Demand Index report shows, demand for all dwelling types rose by 17% in the 12 months to September 2016.

Nationally demand for houses has risen steadily since 2013 when the median price of a house in Australia, according to CoreLogic RP Data, was $540,000 compared to the current median price of $575,000.

The REA Group Property Demand Index shows that demand for houses has been rising since 2013.

A common piece of advice given to first-time buyers who struggle to afford a house in a location they desire, is to try and find an apartment in that neighbourhood instead.

But demand nationally for apartments and units has also been rising steadily since 2013 and as demand rises, prices follow.

The REA Group Property Demand Index shows that demand for units is also rising.

So demand is up, but what about supply?

Listing volumes from CoreLogic RP Data for residential properties show that since 2009 there has been a distinct gap between the number of new listings compared to the total number of listings.

This suggests that overall supply is much lower than demand.

House price growth

So with demand outpacing supply in recent years, here’s a look at how house prices have outpaced growth in other economic indicators such as average household income:

Most baby boomers bought their family home when interest rates were higher, but property prices were lower. Picture: RBA

House prices have been steadily rising for years, with all Australian states and territories having more than one suburb with a median price of $1m, except in Tasmania where median prices hover around $800,000 for some suburbs.

Those like commentator Bernard Salt, who caused a stir at the weekend for saying the reason younger people can’t afford a house is because they buy fancy smash avocado breakfasts, would have purchased their homes at a time when house prices weren’t nearly as high as they are now. So the deposit required would have been lower.

But as prices continue to rise, first-time buyers now need to save large sums of money just to cover upfront costs such as the deposit.

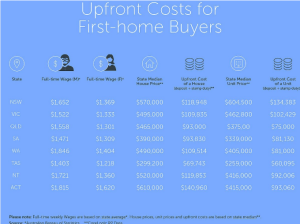

First-home buyers in five Australian states and territories need to save over $100,000 to cover the costs of the deposit and stamp duty, and that’s if they buy a property for the state median price.

Lower interest rates

At the height of the last recession in 1990 the official cash rate was 17% and inflation fell from 7% to 2%, yet last month the Reserve Bank of Australia opted to keep the official cash rate on hold at 1.5% and inflation is currently sitting at 1%.

Interest rates in Australia have never been lower and as a result, first-time buyers now face increased competition at auctions from buyers with deeper pockets.

With interest rates declining, borrowing has never been cheaper. Picture: RBA

While the banks don’t always pass on interest rates cuts in full, credit has never been cheaper and cashed up investors are often able to outbid younger buyers on tighter budgets.

In recent years, investor loans have overtaken owner-occupier loans, as those who may have already paid off the family home make the most of lower interest rates to purchase an investment property.

This RBA chart shows investor loans outpacing owner-occupier loans in recent years. Picture: RBA

HECS & personal debt

By the time most Australians aged under 35 look at buying a home, they are already carrying other forms of debt – HECS and or a car loan- that previous generations didn’t have.

The average student loan debt per household in 2003-04 was $13,900 according to the ABS and by 2009-10 that figure had risen to $17,300.

The average car loan debt per household in 2003-04 was $18,800 and that figure rose to $19,500 in 2009-10, according to the ABS.

So is the affordability younger first-time buyers face really about the food they buy on the weekend or do older, more economically comfortable people fail to realise just how hard buying that first home is today?

Read the full article here